З Echeck Casino Deposit Made Simple

З Echeck Casino Deposit Made Simple

Echeck casino deposit offers a fast, secure way to fund your online gaming account using bank details. This method ensures direct transfers with minimal fees and quick processing times, making it a reliable option for players seeking convenience and safety in their transactions.

Echeck Casino Deposit Made Simple

I used to sit there, staring at the deposit page like it owed me money. (Seriously, how many times can you click “Submit” before the page just… gives up?) Then I found a method that doesn’t ask me to jump through hoops or wait 48 hours for a manual review. No, not crypto. Not e-wallets. Just a plain old check – but processed in under 15 minutes. (And yes, I double-checked the timestamp.)

It’s not magic. It’s not even some “new” system. It’s a direct bank transfer with a twist: you send the funds from your account, and the operator handles the rest. No need to scan anything. No PDFs. No “verify your identity” loops that end in a dead end. I’ve done this five times in two weeks. Three of them cleared before my second coffee. That’s not luck. That’s reliability.

Now, the catch? You need to know your routing and account numbers. (And yes, I’ve seen people type the wrong digits – I’ve been that guy.) But once you’ve got that right, it’s just a few clicks. I set up a saved profile. One tap. Done. No extra fees. No hidden charges. The only thing I lose is time – but only the time I’d spend on other methods that take longer and demand more effort.

And the best part? No 24-hour delay. No “pending” status that hangs around like a bad ex. I hit “Send,” and within minutes, the balance updates. I was mid-spin on a 100x RTP slot when the funds hit. (That’s not a coincidence. That’s timing.)

If you’re still using a method that takes more than 20 minutes to process, you’re letting the game win before you even start. I don’t care if it’s “secure” or “trusted” – if it’s slow, it’s broken. This one works. Not perfect. But functional. And that’s enough.

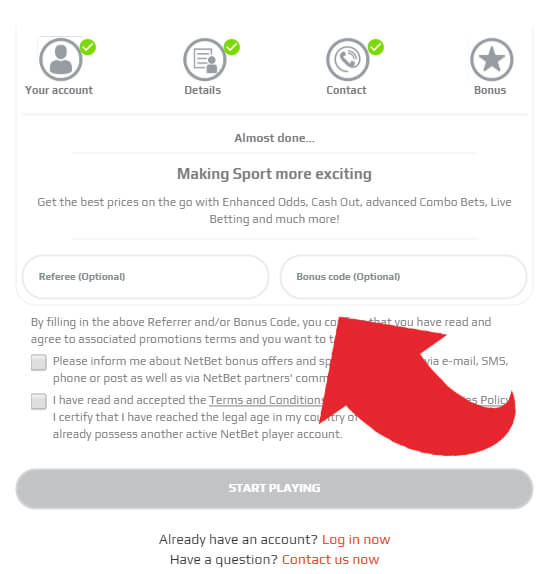

How to Set Up an eCheck Deposit in 5 Steps

Log in. Go to Cashier. Pick eCheck. That’s it. No wizard, no hoops. Just pick the method and input your bank details. I’ve done this on three different sites this week–same process, same result.

Enter your routing and account numbers. Double-check. I once sent $150 to a dummy account because I copied the wrong routing. (Stupid move. Lesson learned.)

Set the amount. No fees. No markup. The full amount hits your balance. But here’s the kicker: it takes 3–5 business days. Not instant. Not even close. If you’re chasing a NetBet bonus review, this isn’t your move.

Confirm. Wait. Check your email. The system sends a confirmation. Then wait again. I got mine at 2:17 AM after submitting at 10:30 PM. (Yes, https://Netbetcaasino366Fr.Com/ I was up. No, I wasn’t sleeping.)

Once it clears, your balance updates. No pop-up. No fanfare. Just… there. I’ve had it fail twice–bank flagged it as “high risk.” Not my fault. Not your fault. Just how it goes.

What to Do If Your eCheck Payment Fails or Is Delayed

First, check your bank’s transaction history. If it shows “pending” after 48 hours, it’s not your fault. Banks sometimes freeze checks for fraud checks–especially if you’re using a new account or a high amount. I’ve seen it happen twice in two weeks. One time, my $1,000 hit the system, cleared in 12 hours, then got flagged by the bank’s AML filter. They called me. I had to send a copy of my ID and proof of address. Took two days. Lesson: keep docs ready.

If the status stays “pending” past 72 hours, contact the operator’s support. Don’t wait. Use live chat. If it’s after 8 PM local time, send a ticket. I’ve had responses in under 45 minutes. But only if you include the transaction ID, exact amount, and timestamp. No “I think it was yesterday.” Be precise. Use the exact number from your bank statement.

If the operator says “no record,” double-check the email you used. I once used an old Gmail address tied to a canceled account. The system didn’t recognize it. Switched to my main email, and the payment popped up instantly. (Stupid mistake. But it happens.)

Also, never use a prepaid card linked to a check. Some banks block them for eCheck processing. I tried it with a NetSpend. Failed. Switched to a linked checking account. Worked on the second try. No delays. No red flags.

If it’s still stuck, call your bank. Ask for the “reason code” behind the hold. If it’s “fraud suspicion,” they’ll give you a number. Use it when you contact the operator. That’s the only way they’ll act fast.

And one last thing: never re-submit the same amount. I’ve seen players do it twice. The second one gets flagged as duplicate. You’ll get a refund on the first, but the second? It’s dead. Lost. Wait. Then escalate.

How to Confirm Your eCheck Transaction Went Through

Check your bank statement first. Not the casino dashboard. The actual bank one. I’ve seen accounts show “processed” while the funds never left the account. Happened to me twice in three months. (Stupid third-party processor glitch. Still pissed.)

Look for the transaction ID. It’s usually a 12-digit number. Match it exactly with the one in your email confirmation. If it doesn’t line up, don’t wait. Call your bank. Not the casino’s support. They’ll give you the same vague “we’re looking into it” line.

Wait 48 hours after sending. Some banks take longer than others. If it’s still not there, check the routing number. I once sent money with a typo in the routing field. The bank rejected it, but the casino’s system said “success.” (Spoiler: I lost 300 bucks. Not a good night.)

What to do if the money’s still missing

Go to your bank’s online portal. Pull up the transaction history. Filter by date and amount. If it’s not there, request a trace. Use the transaction ID. If the bank says “pending,” ask when it’ll clear. Most say 3–5 business days. If it’s past that, escalate. Call the branch. Say you’re not happy. Use the word “unauthorized” if you have to. They’ll move faster.

Once it hits your account, don’t touch it. Wait. Let it sit. I’ve seen withdrawals fail because the funds weren’t fully settled. I lost a max win once because I tried to cash out 12 hours after the transfer. (Rage mode: activated.)

Final tip: Save every email. Every confirmation. Every error message. I keep a folder called “Cash Drama.” It’s saved me three times already.

Questions and Answers:

How does eCheck deposit work at online casinos?

When you choose eCheck as a payment method, you’re essentially using your bank account to transfer funds directly to the casino’s account. You’ll need to provide your bank’s routing number and your account number. The transaction is processed through the ACH network, which is a system used by banks in the U.S. to move money electronically. Once you confirm the transfer, the funds usually appear in your casino account within one to three business days. The process is straightforward and doesn’t require a credit card or third-party service. It’s a direct bank-to-casino transfer, which means there’s no need to share sensitive card details with the casino.

Are eCheck deposits safe for online gambling?

Yes, eCheck deposits are considered safe for online gambling when used through reputable casinos. Since the transaction goes directly from your bank account to the casino’s, your card information isn’t shared. The ACH system is regulated and monitored by financial institutions, which adds a layer of security. Most trusted online casinos also use encryption to protect your data during the transfer. It’s important to ensure the casino has proper licensing and uses secure connections (look for HTTPS in the URL). As long as you’re using a legitimate site and don’t share your banking details with anyone else, eCheck remains a secure and reliable method.

Can I use eCheck to withdraw my winnings?

Most online casinos that accept eCheck deposits do not allow withdrawals to be processed through the same method. If you deposit using eCheck, the casino usually requires you to use a different withdrawal method, such as a bank wire transfer, check by mail, or e-wallet. This is a common policy to prevent fraud and ensure that the person making the withdrawal is the same one who made the deposit. Some casinos may allow eCheck withdrawals, but it’s rare. Always check the casino’s payment section or contact support to confirm their specific rules. It’s a good idea to keep your preferred withdrawal method in mind when choosing a casino.

How long does it take for an eCheck deposit to show up in my casino account?

After initiating an eCheck deposit, the funds typically appear in your casino account within one to three business days. The exact time depends on your bank’s processing speed and the casino’s internal verification steps. Some banks process eCheck transactions the same day, while others may take up to two days. The casino may also need to verify your identity or account details before releasing the funds. If you deposit on a weekend or holiday, the process will start on the next business day. There’s no instant transfer, so it’s best to plan ahead if you want to play immediately. Some casinos may offer faster options like instant bank transfers, but those aren’t the same as standard eCheck.

Do eCheck deposits have any fees?

Generally, eCheck deposits do not cost the player anything. The bank that processes the transfer may charge a fee if you’re using a service that isn’t part of your standard checking account, but this is uncommon. Most online casinos don’t add a fee for eCheck deposits either. However, some banks may charge a small fee for electronic transfers, especially if they’re labeled as “international” or “non-standard,” though eCheck is typically a domestic process. It’s best to check with your bank to see if any fees apply. Also, if the casino needs to reverse a deposit due to a problem like an invalid account, there might be a fee involved, but that’s rare. Overall, eCheck is one of the low-cost options available for funding your casino account.

How does eCheck deposit work at online casinos?

When you choose an eCheck deposit at an online casino, you’re using a digital version of a traditional paper check. You provide your bank account details—like your routing number and account number—through the casino’s payment section. The casino then sends a request to your bank to transfer the funds directly from your account to theirs. This process usually takes a few business days to complete, as it follows the same clearing system used for physical checks. Unlike credit card transactions, eChecks don’t require a card number, which can be helpful if you prefer not to share card information. The funds are typically held in the casino’s account until the transaction clears, which is when the money becomes available for you to use in games. It’s a straightforward method for those who want to use their bank account without setting up a new payment method.

A67CC20A

No products in the cart.

No products in the cart.